Categories

Tags

-

#Patient Engagement Solutions Market

#Masterbatch Market

#Near Infrared Imaging Market

#Contrast Media Injectors Market

#Minimally Invasive Surgical Instruments Market

#Electric Vehicle Market

#Pharmaceutical Packaging Market

#Grow Light Market

#Exoskeleton Market

#Textile Recycling Market

#Artificial Intelligence Market

#Electrical Steel Market

#Automotive Collision Repair Market

#Artificial Intelligence as a Service Market

#Supply Chain Analytics Market

#Biodegradable Plastic Market

#Antifungal Drugs Market

#Hydroponics Market

#Smart Lighting Market

#Biomaterials Market

#Antibody Drug Conjugates Market

#Digital Therapeutics Market

#eSIM Market

#Siding Market

#Oligonucleotide Synthesis Market

#Anti-Money Laundering Market

#cancer biomarkers market

#Automotive Ethernet Market

#Simulation Software Market

#Perimeter Security Market

#Cleaning Robot market

#Meat Substitutes Market

#Construction Additives Market

#Automated Test Equipment Market

#Food Service Equipment Market

#Electric Toothbrush Market

#Silicon Photonics Market

#Electric Ship Market

#Head-Up Display Market

#Water Treatment Chemicals Market

#Synthetic Leather Market

#Operating Room Integration Market

#Hydrogen Peroxide Market

#Automotive Infotainment Market

#Microgrid Market

#Biochar Market

#Metalworking Fluids Market

#Smart Agriculture Market

#Molecular diagnostics Market

#Structural Insulated Panel Market

#Drip Irrigation Market

#Cleanroom Technology Market

#Genomics Market

#Construction Equipment Market

#Urinalysis Market

#LED Lighting Market

#Diesel Generator Market

#Advanced Ceramics Market

#Event Management Software Market

#In-building Wireless Market

#Sterilization Equipment Market

#Sternal Closure Systems Market

#Wound Care Market

#Thermal Energy Storage Market

#Sports Analytics Market

#Automated Guided Vehicle Market

#Buy Now Pay Later Market

#Automotive Lighting Market

#Computer Aided Engineering Market

#Synthetic Biology Market

#Hydrogen Generation Market

#Electric Vehicle Charging Infrastructure Market

#Activated Carbon Market

#Air Purifier Market

#Automotive LiDAR Market

#Steel Rebar Market

#Molded Pulp Packaging Market

#Strontium Market

#Decentralized Identity Market

#Web Real-Time Communication Market

#Supply Chain Security Market

#Flexible Packaging Market

#Veterinary Diagnostics Market

#Solid Oxide Fuel Cell Market

#Thermal Paper Market

#Biofertilizers Market

#Dental Practice Management Software Market

#Hydraulic Cylinder Market

#Augmented Reality Market

#Composites Market

#Metal Casting Market

#Antimicrobial Additives Market

#Physical Security Market

#Digital Map Market

#Data Center Cooling Market

#Coating Equipment Market

#Clinical Trial Imaging Market

#Smart Glass Market

#interactive display market

#Endoscopy Devices Market

#Stainless Steel Market

#Bag-In-Box Container Market

#Flight Simulator Market

#Fuel Cell Market

#Sleep Apnea Devices Market

#Breast Pump Market

#Vitamin K2 Market

#Upstream Bioprocessing Market

#Research Department Explosive Market

#In Vitro Fertilization Market

#Smart Manufacturing Market

#Industrial Air Filtration Market

#Specialty Food Ingredients Market

#Lab Automation Market

#Unmanned Composites Market

#Customer Intelligence Platform Market

#Metaverse Market

#Sales Intelligence Market

#Neurodiagnostics Market

#Epilepsy Monitoring Devices Market

#Fire Protection System Market

#Machine Vision Market

#Nuclear Medicine Market

#Fraud Detection and Prevention Market

#Smart Home Market

#Peptide Synthesis Market

#Embedded Security Market

#Botulinum Toxin Market

#HVAC Systems Market

#Defibrillators Market

#Heat Pump Market

#Elispot and Fluorospot Assay Market

#Spatial Genomics and Transcriptomics Market

#In Vitro Diagnostics (IVD) Market

#Artificial Intelligence in Drug Discovery Market

#Eyewear Market

#Heavy Construction Equipment Market

#Emergency Lighting Market

#Revenue Assurance market

#Ceramic Tiles Market

#Interactive Kiosk Market

#Multiexperience Development Platforms Market

#Cloud Managed Services Market

#Gasoline Direct Injection Market

#5G Security Market

#Biostimulants Market

#Oleochemicals Market

#Taste Modulators Market

#Embolic Protection Devices Market

#Enterprise Content Management Market

#Industrial Fasteners Market

#Track And Trace Solutions Market

#Sportswear Market

#Therapeutic Drug Monitoring Market

#Commercial Refrigeration Equipment Market

#Epoxy Resin Market

#EV Battery Market

#Flooring Market

#Industrial Internet of Things Market

#window coverings market

#LED Lighting

#Automotive Plastics Market

#Exoskeletons Market

#Endoscopes Market

#Personal Care Contract Manufacturing Market

#Industrial Refrigeration Systems Market

#5G Services Market

#bearing market

#Dashboard Camera Market

#Social Commerce Market

#Car Wash Service Market

#U.S. Active Adult (55+) Community Market

#Cell Expansion Market

#Surgical Microscopes Market

#Preparative and Process Chromatography Market

#Softgel Capsules Market

#Restorative Dentistry Market

#Alpha Olefin Market

#Distributed Fiber Optic Sensor Market

#Clinical Decision Support Systems Market

#Laboratory Proficiency Testing Market

#Agriculture Spraying Equipment Market

#Current Transducer Market

#Customer Analytics Market

#Elastomeric Infusion Pumps Market

#Permanent Magnets Market

#Home Insurance Market

#Mold Release Agent Market

#Non-phthalate Plasticizers Market

#Orthopedic Power Tools Market

#Pipe Coatings Market

#Secondary Paper & Paperboard Luxury Packaging Market

#Semiconductor Packaging Market

#Shrink & Stretch Sleeve Labels Market

#Small Gas Engine Market

#Multi-Access Edge Computing Market

#Texture Paints Market

#Trash Bags Market

#U.S. Endoscopy Devices Market

#Warehousing Market

#Anaerobic Adhesives Market

#Education ERP Market

#Geosynthetics Market

#Gene Prediction Tools Market

#Annuloplasty System Market

#Cloud TV Market

#Disconnect Switches Market

#Polymer Binders Market

#Electric Motor Sales Market

#Dental Implants Market

#Tappet Market

#Wax Emulsion Market

#Polynucleotides Injectable Market

#Metaverse in Education Market

#Industrial Evaporators Market

#Buttock Augmentation Market

#Military Wearable Medical Devices Market

#Hydrogel-based Drug Delivery System Market

#Biotech Flavor Market

#CIS Insulin Market

#Osteoporosis Drugs Market

#Sheet Molding and Bulk Molding Compound Market

#Pico Projector Market

#Drug And Gene Delivery Devices Market

#Silver Nanoparticles Market

#Anterior Uveitis Treatment Market

#Functional Protein Market

#Soup Market

#Fabry Disease Treatment Market

#Savory Ingredients Market

#Heart Attack Diagnostics Market

#X-ray Photoelectron Spectroscopy Market

#Cell-based Assays Market

#Hematologic Malignancies Market

#Deep Packet Inspection Market

#Fabric Softener and Conditioner Market

#Beer Kegs Market

#Cardiac Rehabilitation Market

#Laundry Detergent Pods Market

#Hepatitis Therapeutics Market

#ECG Equipment Market

#U.S. IVD And LDT For Autoimmune Diseases Market

#Point Of Care Infectious Disease Testing Market

#Residential Lighting Fixtures Market

#Riding Boots Market

#Targeted DNA RNA Sequencing Market

#Bipolar Disorder Market

#Men’s Swimwear Market

#Proton Therapy Systems Market

#Non-small Cell Lung Cancer Therapeutics Market

#Cold Chain Market

#Industry 4.0 Market

#Intelligent Transportation System Market

#Anatomic Pathology Market

#Rodenticides Market

#Conformal Coatings Market

#Sugar Substitutes Market

#Machine Tools Market

#IT Asset Disposition Market

#Orthopedic Braces And Supports Market

#Dairy Alternatives Market

#Gallium Nitride Semiconductor Devices Market

#Enteral Feeding Devices Market

#Battery Recycling Market

#Car Care Products Market

#Plant-Based Meat Market

#Laboratory Information Management System Market

#Proteomics Market

#Carbon Dioxide Market

#Thermal Spray Coatings Market

#Dairy Processing Equipment Market

#Digital Workplace Market

#Core Banking Software Market

#Patient Monitoring Devices Market

#Dark Fiber Network Market

#Pharmaceutical CDMO Market

#Docks Market

#Plastic Market

#Animal Wound Care Market

#Oral Solid Dosage Contract Manufacturing Market

#Naphthalene Market

#Hearing Aids Market:

#Orthopedic Devices Market

#Business Process Outsourcing Market

#Contract Furniture Market

#U.S. Office Furniture Market

#3D Printing Plastics Market

#Cooling Tower Market

#Fetal Bovine Serum Market

#AI Agents Market

#X-ray Systems Market

#Anti-Pollution Skincare Products Market

#Bedroom Linen Market

#Pet Calming Products Market

#Pre-packaged Sandwiches Market

#Railing Market

#Corn & Corn Starch Derivatives Market

#Digital Mining Market

#Electronic Weighing Machines Market

#Silicone in Electric Vehicles Market

#Surgical Gloves Market

#Medical Display Monitors Market

#Curling Irons Market

#Disposable Endoscopes Market

#Forensic Genomics Market

#Plastic Fencing Market

#Probiotic Cosmetic Products Market

#Rare Disease Clinical Trials Market

#Root Beer Market

#Nitrogen Trifluoride and Fluorine Gas Market

#Women's T-shirts Market

#Bake Stable Pastry Fillings Market

#Fire Resistant Cable Materials Market

#Trona Market

#Nicotine Pouches Market

#Iron and Steel Market

#Huntington's Disease Treatment Market

#Military Tactical Radio Market

#Submarine Cables Market

#Sun Care Products Market

#Surface Disinfectant Products Market

#surgical robotic services market

#Electric Powertrain Market

#Electric Three Wheeler Market

#Electrophoresis Market

#Embedded AI Market

Archives

Contract Furniture Market: Exploring Investment Opportunities

-

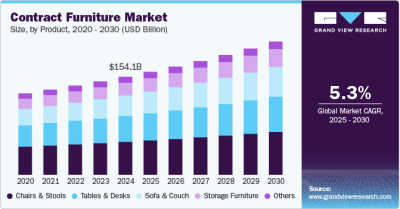

The global contract furniture market was valued at an estimated USD 154.10 billion in 2024 and is projected to grow at a CAGR of 5.3% from 2025 to 2030. This growth is fueled by increasing demand for ergonomic, sustainable, and flexible furniture solutions in commercial spaces. Additionally, the rise of remote and hybrid work models and significant investments in hospitality and office infrastructure are further contributing factors. The adoption of digital marketing strategies and the shift to online distribution channels are also enhancing market expansion.

Countries like China, India, the U.S., the UAE, and the UK are witnessing a surge in commercial developments, including corporate office buildings, retail spaces, luxury hotels, and industrial complexes, leading to increased demand for contract furniture. For instance, Growth Natives, a U.S.-based marketing and customer engagement agency, expanded its corporate offices in November 2022, reflecting the growing need for adaptable workspaces. The company, which reached a milestone of 300 employees within three years, now operates offices spanning India, the U.S., and Canada, covering over 30,000 square feet. Such corporate expansions underscore the growing demand for contract furniture solutions to furnish dynamic and functional work environments.

Gather more insights about the market drivers, restrains and growth of the Global Contract Furniture Market

Moreover, the commercial realty sector is thriving, as highlighted by a December 2023 report on the financialexpress.com, which noted a 33% increase in gross office space leasing across nine Indian metro cities during Q3 2023. This trend indicates sustained investments in office spaces and commercial buildings, further driving contract furniture demand.

Contract Furniture Market Regional Market Insights:

- North America: Accounting for 27.62% of the global market revenue in 2024, North America leads in integrating advanced technologies like cloud-based ERP systems into the contract furniture industry. Companies such as Meadows Office Interiors streamline operations and improve efficiency using these tools, offering services like order tracking, inventory management, and post-sales support.

- United States: The U.S. contract furniture market is projected to grow at a CAGR of 4.2% from 2025 to 2030, driven by increasing demand for ergonomic and flexible furniture and sustainability-focused innovations. The rise of hybrid work environments and investments in hospitality and healthcare sectors further bolster growth.

- Europe: With over 25% of the global market revenue share in 2024, Europe shows a rising inclination toward flexible classrooms and ergonomic furniture in educational institutions. This trend, particularly in the UK, is supported by increased leasing activity in schools and colleges, as highlighted by a Savills blog post in May 2023.

- Asia Pacific: Expected to grow at a CAGR of 6.3% from 2025 to 2030, the Asia Pacific market benefits from rapid urbanization, rising commercial construction activities, and growing demand for premium furnishings. Companies like Indonesia's Warisan are capitalizing on opportunities by supplying high-end furniture for global boutique hotels and resorts.

Browse through Grand View Research's Homecare & Decor Industry Research Reports.

- Artificial Flowers Market: The global artificial flowers market size was estimated at USD 3.09 billion in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2030.

- Outdoor Kitchen Market: The global outdoor kitchen market size was estimated at USD 24.45 billion in 2024 and is expected to grow at a CAGR of 8.9% from 2025 to 2030.

Key Players and Strategic Insights

The contract furniture market is fragmented, with major players including Steelcase, Herman Miller, Haworth, HNI Corporation, and KI. These companies emphasize strategies such as expansions, partnerships, product launches, and sustainability initiatives. For example, in July 2023, Haworth Inc. announced a new manufacturing facility in Chennai, India, with an investment of USD 8-10 million. Set to begin production by 2025, this plant aims to serve both domestic and international markets, including West Asia and Southeast Asia, to meet growing demand.

This combination of market drivers, regional trends, and strategic expansions highlights the robust growth trajectory of the global contract furniture industry.

Key Contract Furniture Companies:

- Haworth Inc.

- Herman Miller Inc.

- Kinnarps Group

- Steelcase Inc.

- HNI Corporation

- Sedus Stoll AG

- KI

- Global Furniture Group

- Martela

- Teknion

- Knoll Inc.

- Kimball International Inc.

Order a free sample PDF of the Contract Furniture Market Intelligence Study, published by Grand View Research.